CERAWeek, Texas 2-Step & SVB Cleantech Collapse

The newsletter for independent thinkers on carbon and climate.

Issue No. 148

Welcome to the latest issue of Carbon Creed - a curated newsletter for independent thinkers on carbon and climate.

Secretary Granholm sets the tone at CERAWeek 2023

CERAWeek - known as the annual gathering of chief executives, policymakers, investors, and other global energy leaders - recently concluded in Houston on March 6-10, 2023.

For the second consecutive year, U.S. Secretary of Energy Jennifer Granholm delivered CERAWeek’s keynote address, discussing the Biden Administration’s energy policies and priorities. Here are a few of her highlights:

Diversifying the Energy Mix. Acknowledging that oil and gas will be part of the energy mix “for years to come,” Secretary Granholm called for a “managed transition” to balance today’s demand while growing more diverse sources of energy for tomorrow.

U.S. Will Lead the Energy Transition. Secretary Granholm detailed new funding and projects from the Inflation Reduction Act and the Infrastructure Investment and Jobs Act. She stated that the billions of dollars made available through these laws for direct competitive funding, investment and production tax credits, and loan guarantees for made-in-America large-scale deployment make the U.S. “irresistible” for new energy and decarbonization technologies.

Pathways to Commercial Liftoff. Secretary Granholm announced a “soft-launch” of the Biden Administration’s "Pathways to Commercial Liftoff” reports that will be released the week of March 13, 2023. This initiative will focus on engaging business to bring four key technologies to commercial liftoff: clean hydrogen, advanced nuclear, carbon management, and long-term storage.

$6 Billion for Industrial Decarbonization. Secretary Granholm also announced $6 billion in grants to fund industrial decarbonization. She noted that the grants will not be narrowly prescribed and will focus on funding projects we can learn from, scale, and export.

Private Sector’s Role in Energy Transition. Secretary Granholm said that energy transition investments are “private sector-led, government-enabled.” She observed that those in oil and gas have the skillsets and knowledge to build critical technologies in new energies at scale, noting connections between offshore drilling and offshore wind, fracking and geothermal, and natural gas transport and clean hydrogen. She expects that the leaders in traditional energy will be the leaders in new energy.

Challenges Ahead. Secretary Granholm cautioned that we have not “vanquished the volatility” in energy markets and face risks of national and economic security and increasing costs of climate change. She called for collaboration in the face of these challenges.

The Production Challenge. Secretary Granholm said she was pleased to see oil and gas production at record levels and noted that the production increase stabilized the world.

International Counterparts. Secretary Granholm described a new level of “focus” on energy security from her international counterparts, evidenced by a desire to import from a variety of sources and not rely on countries who will “weaponize energy.”

LNG. Secretary Granholm noted that Europe is grateful for U.S. LNG exporters, and that European nations are accelerating their own offshore LNG terminals. She noted that European countries recognize that U.S. LNG is cleaner and that they can count on the U.S. to supply it.

Energy-Related Supply Chain. Secretary Granholm highlighted improvements in the energy-related supply chain, observing that 111 companies that make batteries or their components have announced that they are opening in the U.S. She sees opportunity here.

Permitting. Harkening back to last year’s discussion, Secretary Granholm expressed disappointment that Senator Manchin’s bill on permitting did not pass, but stated that she was hopeful Congress would come forward with a permitting bill. She also said that the Department of Energy would be using its present authority to free up permitting for electricity transmission on public lands.

[This post was adapted from the original written for Arnold Porter]

Creed Comments: Yes, the Biden-Harris Administration is taking a “moderate” position on the energy transition. Secretary Granholm’s speech and its emphasis on “all of the above” technologies, indicates that the Administration is pivoting to the middle ahead of the 2024 national elections. It makes sense to do this now to get ahead of the anti-ESG, green energy rhetoric that will surely come once the primaries get into full swing next year. Energy and climate will be front and center in this election cycle. Stay tuned.

We’ll keep you posted on the latest carbon policy and market insights as they happen.

If you have an opinion on any topic covered in this newsletter, please feel free to send me an email at mcleodwl@carboncreed.com.

Thank you for your viewpoint and the value of your time.

SHARE THE WEALTH

🤲🏼 Carbon Creed has approximately 2,800 current subscribers. Our new goal is to reach 3,000 in the next 3 months (03/01/23). Please support Carbon Creed by forwarding this newsletter to 3 friends or colleagues. Thank you!

SUBSTACK FEATURE

Interested in going deeper on topics relating to sustainable mobility? The bi-weekly Su$tainable Mobility newsletter separates the signal from the noise for all things sustainable transportation: electrification, mode shift, active and public transit, and mobility aggregation across both people and goods movement. Read and subscribe here

TRAVELS

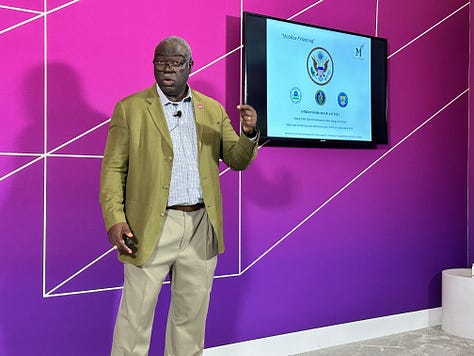

Texas 2-Step: CERAWeek + SXSW 2023

Last week I got to high-stepping in the lone star state! My first stop was in Houston as a speaker at CERAWeek 2023. CERAWeek is often referred to as the Davos of Energy, and I can see why. Attendees included Princes, Presidents, and Prime Ministers from every corner of the planet and CEOs representing every energy technology and market segment imaginable. It was amazing!

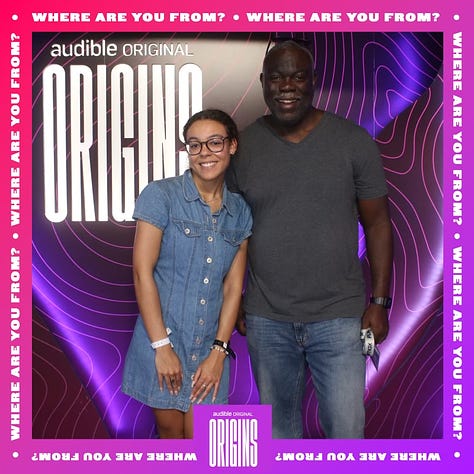

My second stop was the capitol city of Austin for SXSW 2023. I was thrilled to be part of an all-star panel with Suzanne Leta (SunPower), Ethan Zindler (Bloomberg), and Jennifer Hiller (Wall Street Journal). We discussed increasing clean energy access for everyone. The SunPower/RewiringAmerica reception featured a 3D printed house. A huge bonus was having my daughter Carly join me for the occasion!

I highly recommend attending both of these amazing events in 2024. Just work on your Texas 2-step and fast before you go!

BOOKS

Join The Carbon Creed Book Tour!

I’m delighted to share the launch of The Carbon Creed book tour. This book will help you discover your own personal beliefs, values, and practices on decarbonization. It would mean the world to me if you would pre-order the book and become a part of my author community.

For your convenience, here's the link to my pre-order campaign. As someone who cares deeply about our carbon and climate future, it would mean a lot to know you're in my corner!

Thank you,

Walter

INSIGHTS

(source: USA Today)

SVB collapse scares CleanTech industry

The clean-technology industry has just been pulled back from the brink of a disaster brought on by Silicon Valley Bank’s collapse. Quick government action averted the worst outcomes, but that’s just a reminder of how tenuous and politically dependent climate financing is. And now it will be further hampered by the lingering scars of this crisis.

Not only was SVB central to the universe of venture capital, it was also the most prominent hub of financing for clean tech. The bank claimed more than 1,550 clients in the climate and sustainability sectors, from green energy to agriculture. Many had uninsured deposits with the bank that came close to being vaporized almost overnight, potentially leaving them unable to cover payroll and other expenses.

Federal regulators, seeking to stem the fallout of SVB’s collapse to other banks, announced last Sunday that all SVB depositors would have access to their funds on Monday morning, March 13th. But regulators are still looking for a buyer to take over SVB’s business of lending the money climate startups need for growth. And these companies rightly fear that the failure of a bank so closely linked to venture capital will put a chill on investment.

Clean tech can be a tough sell for VCs even in the best of times. They took big losses on Solyndra and other green startups 15 years ago, and those memories are long. It doesn’t help that climate-related tech tends to be far more capital-intensive than, say, a food-delivery app. Producing new or more-efficient forms of energy or agriculture typically requires complicated, expensive equipment and high-price labor. And unfortunately the very idea of fighting climate change is politically controversial, particularly in the US, giving VCs another excuse to shy away.

President Joe Biden’s Inflation Reduction Act was designed to help VCs get over such anxieties, offering billions of dollars in tax credits and other sweeteners and a bulked-up Department of Energy loan office. The bill’s passage inspired more than $40 billion in clean-energy investments in just a few months, for projects with the potential to create 7,000 jobs, according to American Clean Power, an industry trade group. SVB’s collapse threatens to stifle that momentum.

More-established firms, particularly in old-growth clean tech such as solar and wind, will likely get by with alternative sources of cash. Sunrun Inc., the biggest rooftop-solar company in the US, is such a key SVB client that the bank dedicated an entire web page to it. Its business model relies on financing the panels it puts on customers’ houses, and SVB was one of its major lenders. Its shares tumbled 12% on Friday on concerns about its SVB exposure, part of a broader selloff in clean-tech shares tied to SVB. But Sunrun dismissed such worries, saying it had less than $80 million in deposits with SVB and multiple other banks and creditors. The shares regained some ground Monday.

Lean times affecting clean tech just before the passage of the IRA may have limited the cost bloat that can affect other tech startups. SVB’s portfolio should surely be enticing to some large, stable bank, which could make a lot of these issues moot.

Still, this episode threatens to hamstring an industry that was accelerating out of the starting blocks. It could impede Biden’s efforts to build America’s clean-energy and industrial muscles. And even if SVB and its clients end up safe in the arms of some megabank this week, nobody will forget how quickly financing for the bleeding-edge technology needed to fight climate change can get as shaky as an outdated power grid.

Creed Thoughts: What a mess! I don’t seriously think that the SVB collapse is going to seriously impair the clean tech industry. However, it is a precautionary tale about not putting all of your eggs into one basket, especially as we finance the clean energy transition. Startups be warned.

[This post was adapted from the original written by Mark Gongloff for Bloomberg]

RESOURCES

The Science of Climate Change Explained: Facts, Evidence and Proof, published by the New York Times

Currents a podcast featuring in-depth discussions with experts on clean energy and sustainability, published by Norton Rose Fulbright.

Matter of Fact, a weekly newsmagazine that focuses on socioeconomic and climate issues in America, hosted by veteran journalist Soledad O'Brien.

Advancing Inclusion Through Clean Energy Jobs a report by the Brookings Institute.

Congressional Policy Tracker a summary of current federal energy legislation.

Click Clean your favorite apps and tech company clean power rankings.

The Keeling Curve a daily record of global atmospheric CO2 concentration.

PAY IT FORWARD!

Don’t pay me, pay it forward! Help us keep Carbon Creed free - forward this email to 3 friends!

🙏🏾 Questions, comments, advice? Contact us: mcleodwl@carboncreed.com